- Digital Currency Traders

- Posts

- The Longtail Distribution of Returns in Cryptocurrency Trading

The Longtail Distribution of Returns in Cryptocurrency Trading

How to Achieve Better Than Market Average Returns

is a concept that I’ve been working with for years - but I didn’t know how to explain it well until I watched a recent video by Alex Hormozi.

If I Wanted to Become a Millionaire In 2024 Here’s the Full Blueprint

At about 38:00 in his video ‘If I Wanted to Become a Millionaire In 2024 - Here’s the Full Blueprint’, he speaks briefly about The Longtail Distribution of Returns.

And I knew I’d have to return and study this gem.

So I gathered the transcripts from several of Alex’ videos and I created myself a private myGPT to answer my questions from this specialized knowledge base.

As I’m watching his videos, I’ve been asking for more details about any gem he may mention - myGPT returns a very nice summary with rich details, examples, and case studies gathered from several different videos.

In fact, I have been so excited by the results of my new business advisor, I created a number of different advisors and a tutorial ‘How I Created My Own Personal Alex Hormozi Business Advisor - Full Blueprint’ and I’ll share that soon.

Why This Will Make You Rich in Crypto

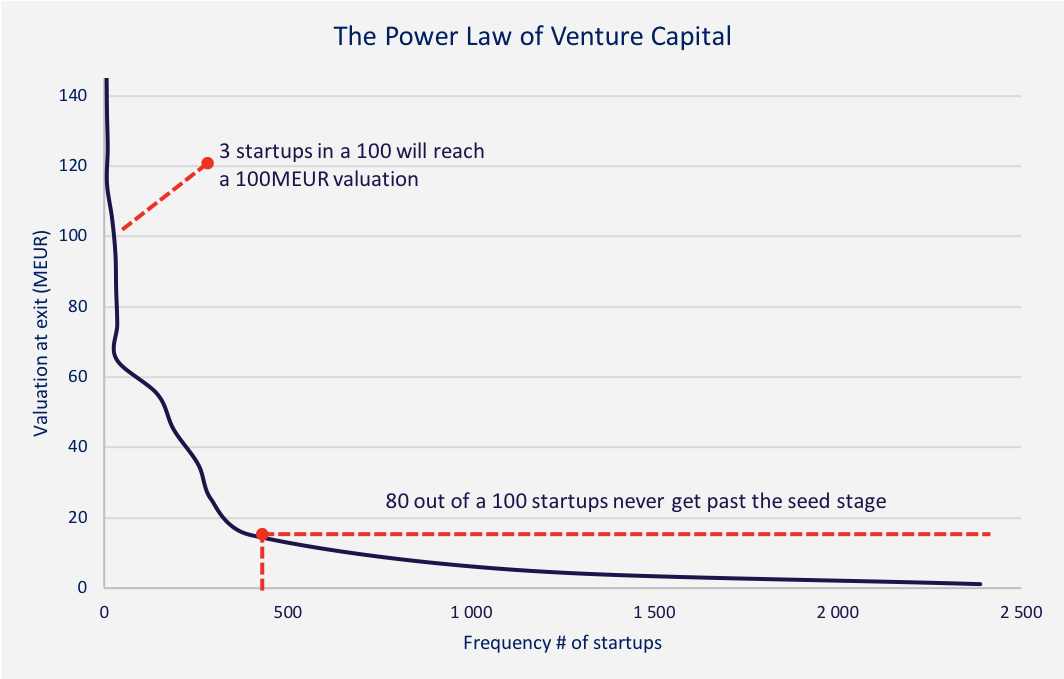

Let’s get technical for a moment; the longtail distribution of returns is a concept often used in finance and business to describe a particular pattern of investment returns or business profits.

As I browse the general knowledge about this concept, I’m grateful again for the way that Alex explains it using baseball metaphors.

In baseball, the outcome distribution is truncated; no matter how well you hit the ball, the maximum number of runs you can score from a single swing is four.

However, in business, the distribution of returns is not truncated in this way.

Sometimes, when you "step up to the plate" in business, you have the potential to score significantly more, such as 1,000 runs.

In the same way, the occasional, very high returns that can be achieved in business, may be substantially greater than the norm.

This longtail distribution of returns underlines the importance of being bold in business endeavors. As Jeff Bezos has suggested, big winners in business often pay for many experiments.

The potential for outsized returns justifies this approach because a single significant success can offset the cost of numerous failed experiments.

In essence, if you do hit a metaphorical home run in business, it can yield returns far exceeding those in more predictable, capped scenarios like baseball.

This is why it's crucial to take calculated risks and pursue opportunities with potentially high payoffs, as they can lead to disproportionately large successes.

Longtail Distribution and Altcoin Season:

Over the years the AltSeason CoPilot demonstrates how a large number of altcoins have a relatively low return and a small number of coins have a significantly higher return.

Our strategy was organized specifically for a longtail distribution return profile and I always struggled to explain it clearly, until now.

For example, a vast majority of our starting crypto positions may yield low or even negative returns, while a small fraction (the 'longtail') can yield extraordinarily high returns.

These few successful investments have proven to more than compensate for the numerous unprofitable ones and the overall performance of the portfolio succeeds far beyond the market average.

Number of Coins In Hold Status

As we graph the onset and decline of each altcoin season, our graphs show an index compiled with the color-coded traded status from the Daily Action Matrix and plotted over time to show us the momentum of Altcoin Season for 270+ coins.

However helpful this data is on a day-to-day basis for trading, it does not show the percentage gains achieved.

Without a distribution chart of actual or backtested returns, we cannot demonstrate just how powerfully the longtail distribution of returns compensates us as we implement this strategy from the beginning to the end of an altcoin season.

Why Does Longtail Distribution Matter?

Here's more breakdown of the longtail distribution of returns concept:

Definition: In a longtail distribution, most investments or business ventures yield relatively modest or even poor returns. However, a few investments or ventures yield exceptionally high returns. These high-return occurrences are fewer in number but significant in impact.

Pareto Principle (80/20 Rule):

The longtail distribution is often related to the Pareto Principle, which states that roughly 80% of effects come from 20% of the causes. In the same way, the AltSeason CoPilot positions so that a small proportion of investments make the majority of profits or gains.

Shape of Distribution:

The term "longtail" comes from the shape of the distribution curve when plotted on a graph. The curve has a 'head' at the left end, representing the small number of high-return instances, and a 'long tail' to the right, representing the large number of low-return instances.

Application in Business and Investing:

Venture Capital:

In venture capital, for example, most startups may fail or provide modest returns, but a small number of them (like tech unicorns) can bring extraordinarily high returns, making up for the losses and providing substantial profits.

Low Risk and Extreme Reward:

The longtail distribution required a special understanding of risk and reward. It is a common mistake to believe that higher rewards are associated with higher risks. Nothing could be further from the truth.

Risk must be managed in Stages 1, 2 and 3 of the trade, and market exposure is systematically increased in Stage 4 of the trade where risk is already managed.

Because we are prepared in advance to add on to the few high-return investments - we gain additional exposure when we have been proven correct - and the success of the longtail winners can be transformational.

Strategic Implications:

For crypto investors who want to become wealthy, understanding the longtail distribution is crucial.

It helps in knowing why we are doing the hard work of diversifying portfolios and managing positions with the Daily Action Matrix, managing risks, and recognizing each day.

We don’t have to know the future and not all trades need to be blockbuster hits to contribute to overall success.

Relation to Compound Growth:

Over time, the impact of high-return investments can be amplified through compound growth, where returns are reinvested to generate additional earnings. This is particularly relevant in long-term investment strategies where the power of compounding can significantly enhance the effect of high-return investments.

This is how it’s possible to become a millionaire in 7 years by creating a $20 per week passive income source.

Making LongTail Part of Your Strategy

The challenge with a longtail distribution is the unpredictability and the difficulty in identifying which items or investments will fall into the highly profitable tail.

In any risky game, nothing in the trading plan is left to chance or luck.

This requires simple analysis, diversification, persistence, and surrender to let the unknown future unfold at its own pace.

Leveraging the longtail distribution strategy can be transformational for investors - in their daily approach to trading and to their long-term wealth.